Construction

Loans

about construction loans

A construction loan makes it possible for future homeowners to cover the costs of land purchase and home construction. These loans are short-term home construction loans designed to help you finance the cost of building your dream home. Unlike a traditional mortgage, a construction home loan has a typical loan term of 12-24 months, just long enough to complete your project.

During that time, construction financing can cover everything from purchasing land and securing permits to paying your contractor’s labor and buying building materials.

For example, you can apply for a construction loan that covers the purchase of land. Or, if you’ve already bought land and are still repaying your land loan, the land loan can be integrated into a construction loan, so that you’re paying two loans into a single, convenient loan. However, if you have already paid your land loan in full, the land can be used as collateral for the construction loan.

what requirements are there to attain a construction loan?

Most construction loans require interest-only payments during the building phase, which can help you keep monthly costs lower until your home is complete.

When the home building process is finished, you can either pay off the balance or transition to a construction-to-permanent loan (sometimes called a one-time-close construction loan), which converts your short-term construction financing into a regular mortgage, without having to reapply.

Step 1: Submit the Proper Documentation

To get started, you or your general contractor will provide your construction loan lender with a detailed construction timeline, plans, and a realistic budget. This helps your loan officer set up your construction loan terms and prepare a clear draw schedule for your project.

Step 2: Funds Are Distributed

Once approved, funds are released in stages, or “draws,” as major milestones are completed. Your lender typically pays the contractor directly, giving you peace of mind that the work is funded and inspected along the way. An inspection may be required before each draw.

Step 3: Convert or Pay Off the Loan

When the home is complete, your new construction loan balance is either paid in full or converted into a permanent mortgage. This step is seamless if you’ve chosen a one-time-close construction loan, so you can focus on moving in and enjoying your new space.

construction loan requirements

Before you apply for a construction loan, it’s helpful to know what most lenders look for. Meeting these requirements helps expedite the approval process and ensures a seamless experience. Meeting these qualifications not only improves your chance of approval but may also help you secure better construction loan rates.

Here are the typical construction loan requirements:

- Verified Income: Lenders need to see documents that prove you have sufficient income to repay the loan.

- Strong Credit Score: Most lenders require a credit score of at least 680 to qualify for a new construction loan.

- Home Appraisal: An appraisal helps determine the expected value of the finished home, ensuring your construction loan amount aligns with that value.

- Low Debt-to-Income Ratio: A healthy DTI shows you can comfortably take on additional debt.

- Detailed Construction Plan: A reputable builder must provide a detailed plan and schedule, which the lender will review before approving funds.

- Down Payment: A minimum down payment of 5-20% is usually required for construction financing loans.

types of construction loans

There are several ways to finance your dream home, depending on how you want to handle the mortgage once construction is complete. Understanding the types of construction loans available helps you choose the best fit for your budget and timeline.

- Construction-to-permanent loans

A construction-to-permanent loan is also known as a single-close or one-time-close construction loan. It allows you to apply once and pay closing costs a single time. Your short-term construction loan automatically converts into a permanent mortgage upon completion of the build, simplifying the process and saving you time and money.

At Canopy Credit Union, we offer several government-backed construction-to-permanent loans with lower down payments and more flexible requirements than conventional financing.

These programs make it easier for members to access new home construction loans with competitive construction loan interest rates and a smooth transition into homeownership.

- USDA Combination Construction-to-Permanent (Single Close) Loan Program: Backed by the U.S. Department of Agriculture, this program is available in eligible rural areas with populations up to 35,000.

- FHA One-Time Close Loan: Available for one-unit stick-built primary residences, new manufactured homes, and modular homes. Requires as little as 3.5% down payment.

- VA Construction Loan Program: Designed for qualifying service members and veterans, this loan may not require a down payment, making it one of the most affordable options for building your home.

- construction-only loans

A construction-only loan is ideal if you want more control over your long-term mortgage. Unlike a construction-to-permanent loan, this option requires you to qualify for and close on two separate loans: one for the construction financing and another for the permanent mortgage once the home is complete.

While this means you’ll have two sets of closing costs, you also gain the flexibility to shop around and compare construction loan rates and mortgage options separately. In this case, it can potentially save you money in the long run.

- renovation loans

If you’re looking to transform a fixer-upper into your dream home, a renovation loan could be the perfect solution. This type of home construction loan combines the purchase price, repairs, and desired upgrades into one fixed-rate mortgage. The loan amount is based on the home’s estimated value after renovations are completed.

These construction financing loans help you improve your home’s comfort and value, without juggling multiple loans or high-interest credit cards.

At Canopy Credit Union, we make it simple to finance major renovations with several options:

- FHA 203(k) Loan: Allows homebuyers and current homeowners to finance up to $75,000 into their mortgage to repair, improve, or upgrade a home that’s at least one year old.

- VA Renovation Loan: Offers up to 100% financing for qualifying veterans, active-duty military personnel, and their families.

- USDA Renovation Loan: Available in two types. Limited USDA Renovation Loans (up to $35,000 for repairs) and Full USDA Renovation Loans (no minimum or maximum amount).

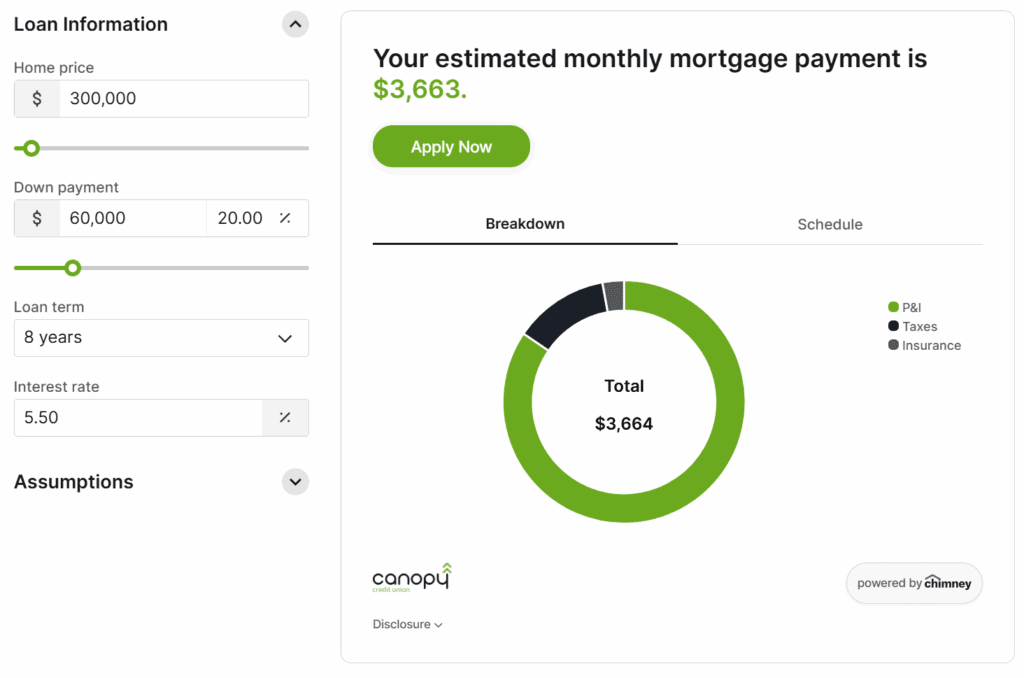

calculate your construction loan payment

Use our construction loan calculator to:

- Estimate your monthly interest-only payments during the construction phase

- See what your payment could look like once your construction-to-permanent loan converts into a conventional mortgage

- Compare different construction loan rates and terms to find the best fit for your budget

Knowing your numbers upfront can give you confidence as you plan your build and discuss it with your contractor.

- apply for a construction loan online

At Canopy CU, we make it easy to get started. No matter the size or budget of your project, we’ll guide you every step of the way, making financing your dream home feel stress-free and straightforward.

construction loan FAQs

Here are the commonly asked questions for construction loans from our Spokane community members.

Typically, it has strict requirements because there is no completed home to act as collateral. Often, a construction home requires more documentation and takes longer to process, as multiple people are needed to approve the loan.

As construction financing is seen as riskier by lenders, construction loans cost more than mortgage loans. Nonetheless, a construction loan allows you to own a new home while it is being built, whereas a mortgage enables new homeowners to purchase an existing home.

It can take 30-45 days or more to secure a construction loan, as it requires additional processing and multiple approvals.

A land loan can be converted into a construction loan by combining the purchase of land and the construction into a single loan, in which the land serves as collateral for the loan.

If you own your land with zero mortgage or liens, you could use its equity as collateral for the construction loan.