Conventional Mortgage

conventional mortgages in spokane

Conventional mortgages are one of the known home loans available for the people of Spokane. If you have good credit and stable income, you can qualify for a conventional mortgage, especially if you have savings or equity to support your down payment and part of your monthly mortgage payments.

In this article, we go in-depth on what conventional mortgages are, how they work, and what factors impact the rates that will be offered to you. At Canopy CU, we empower you in your financial journey with loans that you may qualify for.

what are conventional mortgages and how do they work?

A conventional mortgage is a type of home loan offered by private lenders like banks and mortgage companies that isn’t insured or guaranteed by a government agency (unlike FHA, VA, or USDA loans).

Most conventional mortgages are conforming loans. This means that they meet guidelines set by the two government-sponsored enterprises (GSEs): the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corp. (Freddie Mac).

While conventional loans often require a higher credit score and lower debt-to-income ratio than government-backed alternatives, they also allow for as little as 3% down payment, especially for first-time home buyers with higher loan limits for those who qualify. Due to these standards, conventional mortgages are ideal for borrowers with strong credit, stable income, and enough equity or savings.

Like all mortgages, conventional loans work as follows:

Conventional Mortgage Application

The borrower applies for a conventional loan for a specific amount to a lender.

Conventional Mortgage Qualification

The lender reviews the borrower’s application to determine if they are eligible for the loan. If so, the borrower is approved for the loan.

Conventional Mortgage Finalization

The loan is finalized, and the borrower can close the sale for their new home, which they’ll repay in monthly installments.

- conventional home loan requirements

To be approved for a conventional mortgage, the borrower must meet the lender’s credit and financial requirements. Here are the typical requirements to qualify for a conventional mortgage.

First-time home buyers can qualify for a conventional loan with a down payment as low as 3%. However, larger down payments can reduce your monthly payment and eliminate the need for private mortgage insurance (PMI).

As most conventional mortgages meet the guidelines set by Fannie Mae and Freddie Mac, the national loan limit for a single-family home is $806,500 as of 2025. The said limit is the same for Spokane.

Most conventional lenders require a minimum credit score of 620. However, lenders qualify borrowers for better interest rates, lower PMI premiums, and more favorable loan options if they have higher credit scores.

The Debt-to-Income (DTI) ratio is the percentage of your monthly income spent on debt. To qualify for a conventional mortgage, the borrower must have a DTI ratio of 45% or lower. The lower the DIT, the more confidence your lenders have that you can responsibly budget for mortgage payments.

If the borrower pays a down payment of less than 20%, most lenders would require them to pay for PMI to protect the loan. The PMI for conventional mortgages typically ranges from 0.46% to 1.5% of the loan amount annually. However, the borrower can request to cancel PMI once their loan-to-value (LTV) ratio reaches 80%.

types of conventional mortgages

If you qualify for a conventional mortgage, you may be eligible for the different types of conventional loans with varying conditions of payment:

Your interest rate never changes, allowing you to have the same monthly principal and interest payment for the length of the loan.

After a fixed introductory rate, the rate changes at preset intervals depending on the index rate plus a margin determined by the lender.

A conforming mortgage follows the guidelines set by the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae and Freddie Mac.

Some lenders extend financing even if a borrower’s credit is below 620 or has a less favorable financial profile.

If the borrower pays a down payment of less than 20%, most lenders would require them to pay for PMI to protect the loan. The PMI for conventional mortgages typically ranges from 0.46% to 1.5% of the loan amount annually. However, the borrower can request to cancel PMI once their loan-to-value (LTV) ratio reaches 80%.

conventional mortgage rates

Conventional mortgage rates fluctuate frequently based on economic conditions, financial markets, and Federal Reserve actions. As of January 2025, the average 30-year conventional mortgage rate is 6.96%, which is a significant increase from historical lows like 2.86% in 2021.

The following factors influence the interest rates offered to you for a conventional home loan:

- Loan term (e.g., 15-year vs. 30-year)

- Loan amount (larger loans often come with slightly higher rates)

- Fixed vs. adjustable rate mortgage

- Market supply and demand for mortgage-backed securities

- Federal Reserve policy (when the Fed raises rates, banks often increase mortgage rates in response)

The rates you’ll be offered will also depend on your credit score, down payment size, and overall financial health. Typically, better credit and a larger down payment result in lower conventional mortgage rates.

Fortunately, borrowers can further lower their interest rate by paying discount points or fees paid directly to the lender. One point can equal 1% of the loan amount and generally lowers your interest rate by about 0.25%.

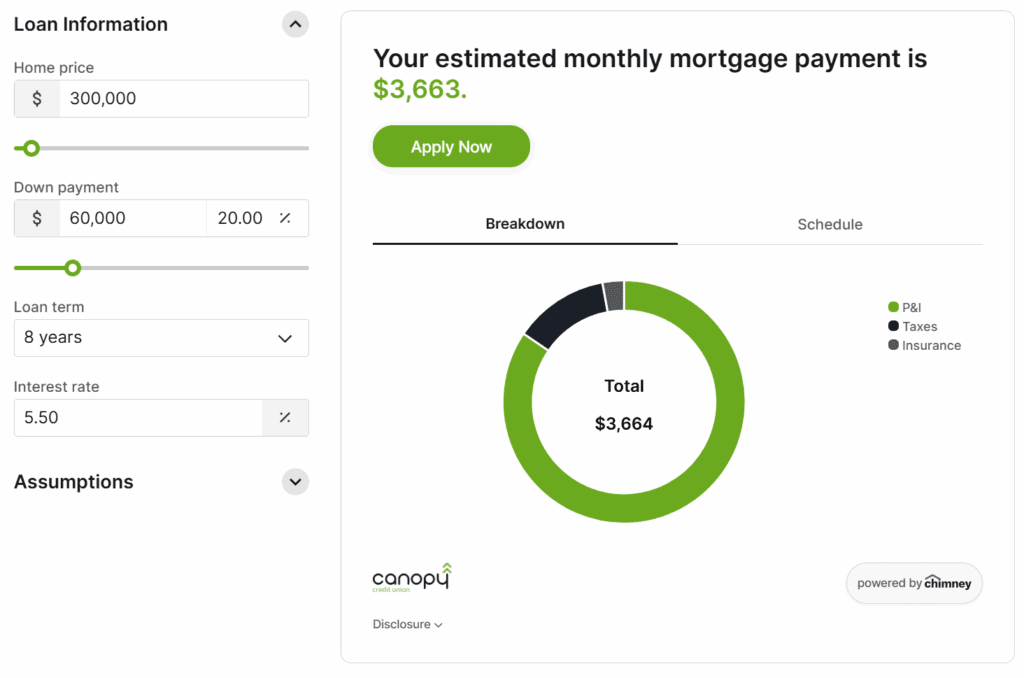

calculate your conventional mortgage payment

Use our mortgage calculator below to see how your monthly mortgage payment will depend on your home price, down payment, interest rate, and more.

FHA Loan vs Conventional Loan

A Federal Housing Administration (FHA) loan is a loan backed by the FHA.

Because the government insures it, it has less restrictive qualifications, allowing home buyers with lower credit scores or smaller down payments to afford a home. FHA loans are best for people who may not qualify for conventional mortgages.

When buying a home, you may be wondering whether you should apply for an FHA loan or a conventional loan. Both offer the following advantages, as seen in the following table:

FHA Loan | Conventional Loan | |

|---|---|---|

Interest Rate for a 30-year loan (2025) | 6.62% | 6.96% |

Down Payment | As low as 3.5% with a credit score of 580 or higher 10% with a credit score of 500 to 579 | As low as 3% |

Credit Score Requirements | 500 | 620 |

DTI Ratio | 45-50% | Up to 45% |

National Loan Limit | FHA limit: $524,225 | FHFA limit: $806,500 |

Private Mortgage Insurance | 0.46% to 1.5% | 0.46% to 1.5% |

Ideal For | First-time home buyers Borrowers with limited financial history Borrowers who have experienced financial setbacks | Borrowers with good credit, stable income, and enough equity or savings |

As noted, FHA loans have less restrictive standards, ideal for those with less favorable credit and finances. While borrowers may have to pay for a larger down payment, it allows them to qualify for a housing loan with lower interest rates.

FHA loan application online

An FHA loan is a popular option for first-time homebuyers and individuals who may not meet the stricter requirements of conventional mortgages. At Canopy Credit Union, we proudly offer FHA loans to help our Spokane members access affordable homeownership. Our friendly, local lending team will guide you through every step—making the process easy to understand and tailored to your financial needs.

Ready to get started?

hear from these happy borrowers

We’ve helped countless members throughout the Inland Northwest achieve their dream of owning a home. Don’t just take our word for it, hear from these happy homeowners who trusted Canopy Credit Union with their home financing!

I was recommended by a friend to refi through them because the big mortgage company that I was currently going through never got back to me even though I called, left a message and I even left a request for help on their website. Canopy got a hold of me in less than 24 hrs and made everything as convenient for me as possible and at my pace. Thank you for not making me feel like a number.

– Payeng L. | ☆☆☆☆☆

If you need anything Mortgage related, talk to Renee. Extremely knowledgeable and helpful in all aspects of purchasing a home. Highly recommend using Canopy and their team.

– Seth S. | ☆☆☆☆☆

Renee Lance was AMAZING helping her buyer clients purchase one of my listings. It was a very prolonged, complicated, unusual purchase, and she gave it her all, even though it was a small sale for real estate. I have worked 18 years in the biz with hundreds of lenders, and Renee went above and beyond!

– BethAnn L. | ☆☆☆☆☆

refinancing FAQs

While FHA loans are known for low interest rates and lenient credit requirements, they do come with additional costs. Borrowers are required to pay both:

- An upfront Mortgage Insurance Premium (MIP)—typically 1.75% of the loan amount, and

- An annual MIP, which is paid monthly and varies based on your loan’s size, term, and loan-to-value (LTV) ratio.

These insurance premiums help protect FHA-approved lenders but add to your monthly mortgage payments. Use our FHA mortgage calculator to estimate your monthly costs—or consult with us to compare different loan programs and find the right fit for your budget.

To apply for an FHA home loan, you’ll need to go through an FHA-approved lender, like Canopy Credit Union. The process includes:

- Completing a loan application,

- Submitting financial documents such as pay stubs, credit reports, and employment history, and

- Ensuring the property meets FHA home loan guidelines.

If you're not ready to commit just yet, we offer a pre-approval process to help you understand how much you may qualify to borrow, without any pressure or obligation. It’s a great first step toward buying your home with confidence.

FHA loans have several refinancing options, including the FHA Streamline Refinance, which lowers your monthly mortgage payments or changes your loan term.

These options require less paperwork and often don’t need a new appraisal, making the process faster and easier. If you're wondering whether refinancing your FHA loan is right for you, our team is here to walk you through your options.

our latest articles

FHA loan resources

Discover more information on FHA Loans, other loan programs, and more.

News Listing Grid will go here. Waiting for News population.