Specialty

Loans

Specialty Loans in Spokane

At Canopy Credit Union, we understand that not every financial profile fits neatly into traditional lending models. That’s why we offer specialty loans and asset-based lending programs designed to meet you where you are. Are you growing your business, investing in new property, or looking for flexible financing options? Our loan advisors are here to help you find a solution that works for your goals.

What are specialty loans and how do they work?

Specialty loans are non-traditional financing solutions for borrowers with unique circumstances that may not fit the typical, rigid criteria of banks. Because of their more flexible terms than traditional loans, they can offer finance that is tailored to the unique needs of each business. They fill the financing gap left by banks by providing capital through asset-based lending, revenue-based financing, and more.

Step 1: Application

Applying for a specialty loan starts with a few essential documents. While eligibility requirements vary by lender, most specialty finance lending programs will ask for proof of identity and proof of address. Depending on the type of loan program you choose, you may also be asked for financial records that outline your assets, investments, or business income.

Step 2: Screening

Specialty lenders, especially for business loans, underwrite loans manually. This process allows them to approach each application on a case-by-case basis. They consider the full nature and complexities of an applicant’s personal and financial situation. This way, they can offer flexible financing options tailored to the applicant’s needs.

Step 3: Approval

Once the loan is approved for specialty financing, the applicant obtains the capital they need for their investment purposes, from business expansion to real estate purchase.

specialty loan requirements

Every specialty lender has its own eligibility requirements, depending on the type of specialty loan program or asset-based lending option you apply for. While details may vary, most specialty finance lending programs will ask for the following documentation:

- Proof of Identity: A valid government-issued ID to verify who you are.

- Proof of Address: Utility bills or official documents confirming your current residence.

- Evidence of Affordability: Income statements or financial records showing your ability to repay the loan.

- Proof of Property Value: An appraisal or valuation report for the property or asset against which the loan will be secured.

types of specialty loans for businesses

Specialty lenders provide flexible financing programs designed to support developers, property investors, and business owners who need custom solutions beyond traditional lending. These specialty loan programs help you access the capital you need for growth, expansion, or investment.

- Private Debt

Private debt refers to loans offered outside of public markets and privately negotiated between two parties. This type of specialty finance lending provides businesses and investors with tailored financing options that aren’t typically available through traditional banks.

- Esoteric Finance

Esoteric finance involves complex investment vehicles designed for specialized investors. These assets can be more challenging to value due to their unique pricing or structure, but they offer opportunities for diversified specialty investments and higher potential returns.

- Revenue-Based Financing (RBF)

With revenue-based financing, capital is provided in exchange for a percentage of your business’s future revenue. This option is great for growing companies with strong sales potential but limited collateral. Payments fluctuate based on your income, helping maintain a steady cash flow.

- Asset-Based Lending (ABL)

In asset-based lending, a business uses its assets (inventory, receivables, or equipment) as collateral to secure a loan. The amount you can borrow is determined by the value of your assets, not just your cash flow or credit score. This makes ABL programs ideal for businesses seeking flexible working capital.

types of specialty loans for homebuyers and homeowners

Specialty home loan programs differ from general specialty loans. These programs are designed specifically for home buyers and homeowners who need financing for unique situations that traditional mortgage loans might not fully accommodate.

Bridge Loans

Bridge loans are short-term financing options that help homeowners buy a new house before selling their current one. This type of specialty mortgage “bridges” the gap between transactions, providing the capital you need to secure your next home without the stress of perfectly timing both closings.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) allows homeowners to borrow against the equity they’ve built in their home. Similar to a credit card, a HELOC gives you a revolving line of credit—borrow, repay, and borrow again up to your approved limit. It’s a flexible way to fund home improvements, debt consolidation, or other financial goals.

Down Payment Assistance Programs

Down Payment Assistance (DPA) programs help make homeownership more achievable for first-time buyers, veterans, public service professionals, and low- to moderate-income families. These programs offer funds or grants to cover some or all of the down payment costs, making it easier to qualify for a mortgage and purchase your home sooner.

specialty loan rates

Specialty finance lending programs are designed to help borrowers who don’t fit the traditional lending models. Through the personalized, case-by-case approach, specialty loans provide the borrowers with the capital that they need. However, this approach puts a risk to specialty lenders.

To mitigate this risk, specialty loans come with unique terms and conditions. They have higher rates than standard local programs to balance the added flexibility and risk that specialty leaders take on. This protects the lenders while still helping borrowers obtain financing that might not be available elsewhere.

Rate Table will go here.

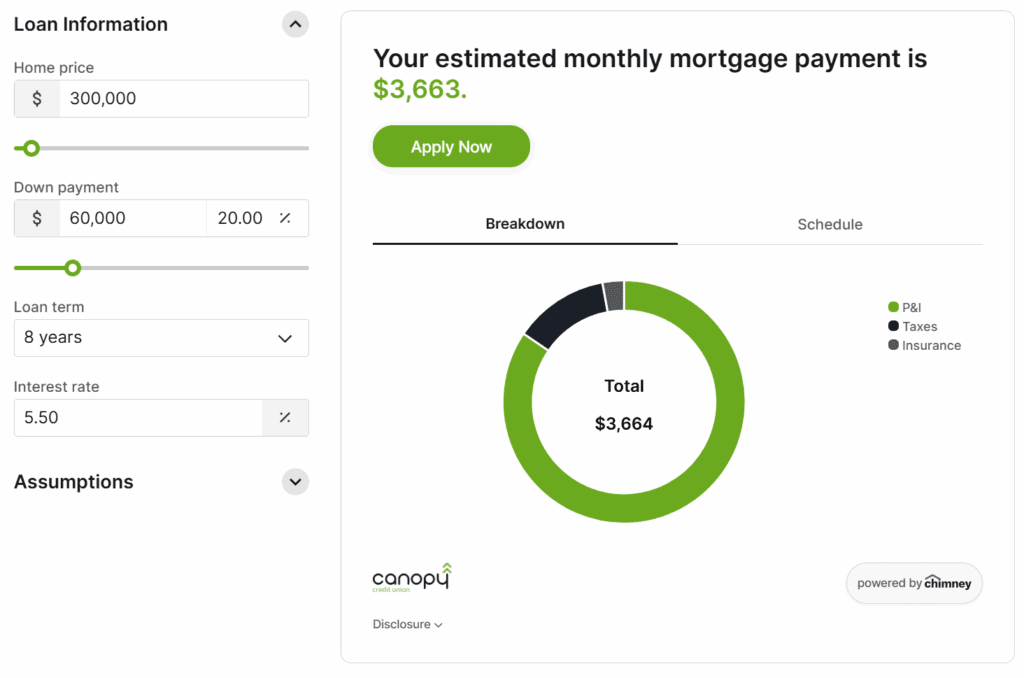

calculate your specialty loan payment

Curious about what your specialty loan payments might look like? Use our loan calculator below to estimate your monthly payment based on your collateral value, loan amount, and terms of repayment.

apply for a specialty loan online

Specialty loans allow borrowers who don’t fit the traditional lending criteria the capital they need. If you require financing for a real estate investment or business expansion, our advisors at Canopy CU are here to help you tailor financing options to fit your needs. Apply online today, and we’ll reach back to you soon.

hear from these happy borrowers

As business owners, investors, and community members across Spokane, our members trust us to provide the specialty financing and loan programs that help them reach their goals. Browse through their stories to discover how they’ve found the support, flexibility, and confidence they needed, right here with Canopy CU.

If you need anything Mortgage related, talk to Renee. Extremely knowledgeable and helpful in all aspects of purchasing a home. Highly recommend using Canopy and their team.

– Seth S. | ☆☆☆☆☆

Leah absolutely killed it! She under-promised and overdelivered every step of the way. I can’t believe how smooth this process went for opening up a HELOC. I strongly encourage anyone to work with this credit union, and specifically Leah! Thank you so much! You are a legend.

– Stephen M. | ☆☆☆☆☆

Canopy CU is a financial institution that feels like family. Rich Jones was awesome to work with. He offered some solid advice and is genuinely interested in our financial journey and helping us reach our goals. They also have great products and local decision-making. That’s huge.

– Kris F. | ☆☆☆☆☆

specialty loan FAQs

Here are the frequently asked questions of our members regarding specialty loans.

No, specialty loans are not home loans. Specialty finance lending is typically unregulated and designed for intermediaries, property investors, developers, and landlords who need capital for investment purposes—not for buying a home to live in.

Not necessarily. While specialty loans are considered unregulated, that doesn’t mean they’re unsafe. It simply means they’re more flexible and can be issued faster than traditional, regulated loan programs. However, it’s important to note that specialty finance lending is still subject to oversight. The U.S. Securities and Exchange Commission (SEC) supervises these loans for anti–money laundering and transparency purposes, helping ensure accountability and ethical lending practices.

Specialty loans provide borrowers access to capital and flexible terms. It boosts their credit profile once borrowers have repaid their debt. In addition, it preserves ownership of the business, unlike equity financing, which requires giving up a portion of ownership in the borrower’s company.

Homeowners benefit from specialty home loan programs if they are not eligible for traditional banking methods. Through these home loans, they can access loaning options for buying a home or using the home as collateral.

The best specialty loan program depends on your unique financing goals, credit profile, and the type of investment or project you’re pursuing. At Canopy Credit Union, our experienced loan advisors take time to understand your situation and recommend the right specialty lending option for your needs. Contact us today to talk with a Canopy loan advisor and discover the best specialty finance solution for you.

our latest articles

specialty loan resources

Learn more about the subject of specialty loans with Canopy CU.

News Listing Grid will go here. Waiting for News population.