Visa

Credit Cards

Flexible, convenient Visa credit card

Your life, rewarded

Canopy offers Visa Credit Cards designed to reward your everyday spending — low rates, no annual fee, and real-time fraud alerts. Pick the card with rewards and rates that work best for you.

Need help finding the right fit? We’ve got you covered.

Visa Credit Card | Visa Rewards Card | Visa Classic Card |

|---|---|---|

Rate | Non-variable, as low as 9.90% APR* | Variable, as low as 11.50% APR* |

Annual Fee | $0 | $0 |

Rewards | 1% cashback + points for travel, merchandise, gift cards | None |

Best For | Everyday spending, earning rewards, balance transfers | Building credit or keeping it simple |

Balance Transfer Bonus | Earn double points on transferred balances | N/A |

Digital Wallet | 10.74% – 17.49Apple Pay, Google Pay, Samsung Pay, Garmin, Fitbit | Apple Pay, Google Pay, Samsung Pay, Garmin, Fitbit |

*Annual Percentage Rate may vary based on approved credit. Variable rates range from 11.50% APR to 18% APR.

want fraud protection? canopy is here to help

Our Fraud Monitoring Program alerts you by call or text if suspicious activity occurs on your card. High-risk transactions may temporarily block your card until you verify them.

Important: Canopy will never ask for sensitive information over the phone.

- Calls come from 877.253.8964; texts come from 37268

- Lost or stolen card? Call 833.221.8684

- Dispute a charge? Call 833.221.8685

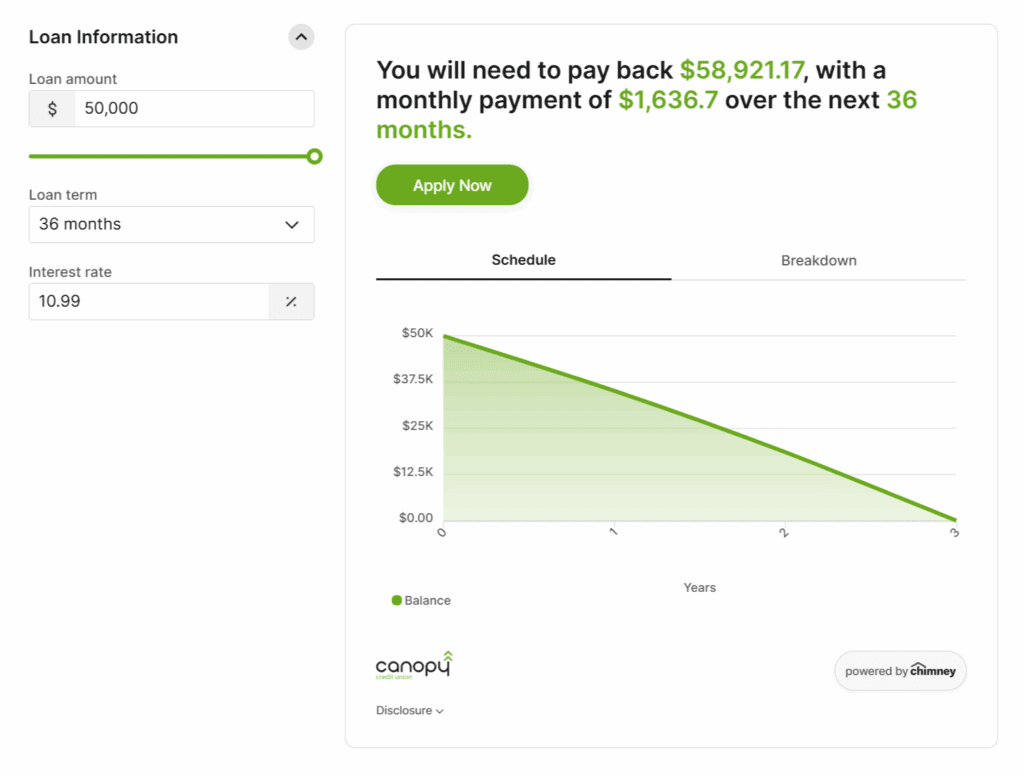

credit card calculators

Want to find out what your monthly payment would be to pay off your balance in your desired timeframe?

Check out our Credit Card Payment Calculator!

visa credit card FAQs

Rewarding answers for all your questions.

We will request your two most recent pay stubs and any payoff statements if you have balance transfers.

We strive to follow-up with you within 1-2 business days.

Once you're approved, we can print your credit card at any of our locations during business hours so you can start using it right away OR we can mail your new card to you but it may take 7 - 10 business days to arrive.

Visa Credit Card payments are due the 17th of every month.

If you don't make your payment by the 17th of each month, you may be charged a fee of 15% of the minimum payment due with a maximum of $35.

Make secure, contactless payments on the go. Add your Canopy Visa Card to Apple Pay, Google Pay, Samsung Pay, Garmin, or Fitbit. Easy setup, fast payments, and your information stays safe.

Learn how to add your card to your digital wallet

Your interest rate depends on your credit score.

- If you’re an existing Canopy member: You can check your credit score for free using the Savvy Money Credit Score tool after logging into your account.

- If you’re not a member: You can get a rough estimate of your credit score using apps like Credit Karma or Credit Sesame. Keep in mind that the score lenders see may differ.

- Free official credit report: Everyone is entitled to one free credit report per year at annualcreditreport.com.

If you’d like to boost your credit limit, we can help! Just reach out to us, and we’ll review your account to see what increase might be available.

Yes! You can add family members or others to your account as authorized users. They can make purchases on the card while you retain control and manage payments.

Your monthly payment will be either 2.5% of your balance or $10 - whichever is greater.

We do have a small foreign transaction fee. You will be charged up to 1% of every US-equivalent dollar spent and 2.5% of each cash advance ($1 minimum).